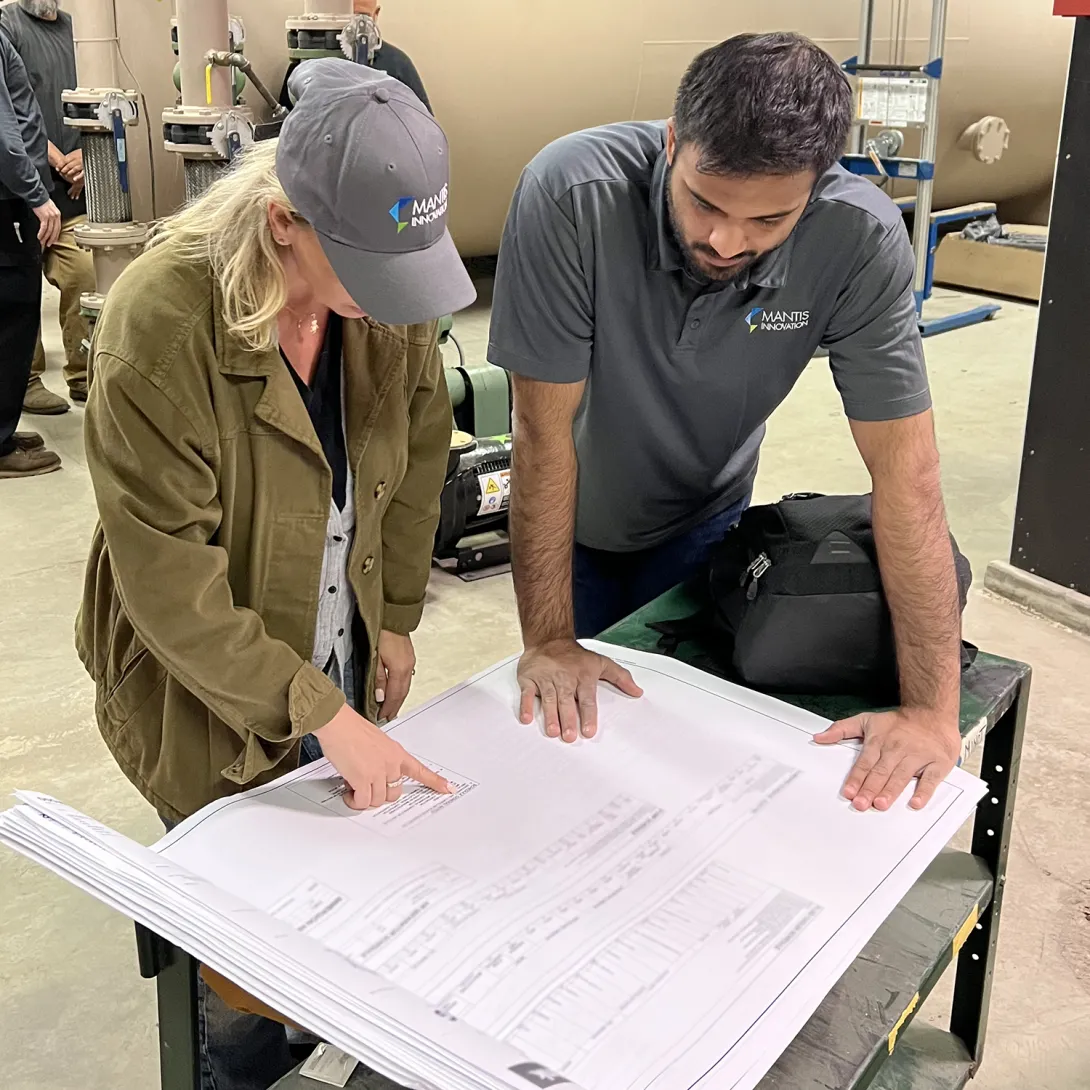

At Mantis Innovation, we offer integrated energy and facility solutions tailored for the manufacturing sector. We focus on modernizing facilities to enhance resilience and reduce disruptions. Our approach aims to drive economic value and improve overall performance across various manufacturing industries.

WHAT WE DO

Unlocking efficiencies is our driving force. Whether in energy efficiency, energy procurement, or facilities management, we develop tailored strategies that empower you to optimize your operations, streamline processes, and minimize cost.

Our game-changing impact

2 Billion

SQ FT of facility space managed

10,000

Clients across North America

8.8 MMT

Reduction in Greenhouse Gas

Who we work for

We optimize facilities, energy procurement, and energy operations across a wide range of industries.

- Manufacturing

- Financial Services

- Higher Education

- Healthcare

- Data Centers

- Retail

- Public Sector

- Real Estate

Manage risk and embrace renewables with our data-driven, customized procurement strategies

We develop procurement strategies tailored to your specific energy needs. Our solutions help you manage risk, control costs, and transition to renewable energy sources, ensuring sustainability and long-term savings.

Learn About Our Approach

Illuminating innovation: University of Hartford's journey to energy efficiency with LED lighting upgrade

To keep up with the modern expectations of educational facilities and support its mission to become a future-facing institution, the University of Hartford committed resources to reduce its carbon footprint and encourage green solutions.

Complete Expertise Matters

At Mantis Innovation, we enhance facility performance through strategic energy procurement, renewable options, risk management, and comprehensive sustainability strategies that ensure budget certainty, strong ROI, and reduced carbon emissions.

- Energy Procurement & Green Energy

- Demand Response

- Solar Solutions

- EV Charging

- Roofs Asset Management

- Pavement Asset Management

- HVAC/Mechanical Optimization

- Smart & Connected Buildings

Our Latest Insights

Ready to Go?

Let’s Talk and Start Unlocking Efficiencies Today

Join the growing number of businesses optimizing their facilities and energy management with us.