This market update includes a natural gas storage update, electric and natural gas price movement, and a weather outlook. By utilizing this information, you can make better-informed energy decisions. This is general information to give you a quick summary of the market, please contact the energy solutions team at Mantis Innovation for additional information. Additionally, you can get these updates sent to your inbox weekly by signing up here.

Natural Gas

The amount of natural gas available for usage is very important in the energy industry because, among other things, it is used for heating, and as a main fuel source for generating electricity at power plants to be consumed by both homes and businesses. By comparing current levels of natural gas storage to the levels of last year and the past five years, an assessment as to the state of natural gas supplies to meet demand can be made.

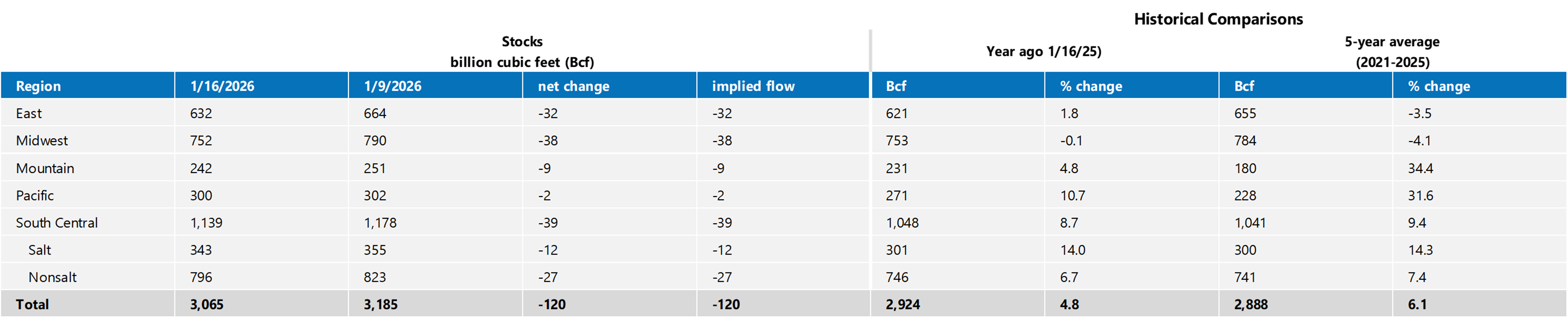

Final estimates for week ending 1/16/26 were for a withdrawal in the 98 to 101 Bcf range.

The total net withdrawal came in way above the final estimates, with 120 Bcf being taken out of storage.

Storage is now 141 Bcf above last year, and 177 Bcf above the 5-year average, which is now above the 5-year historical range.

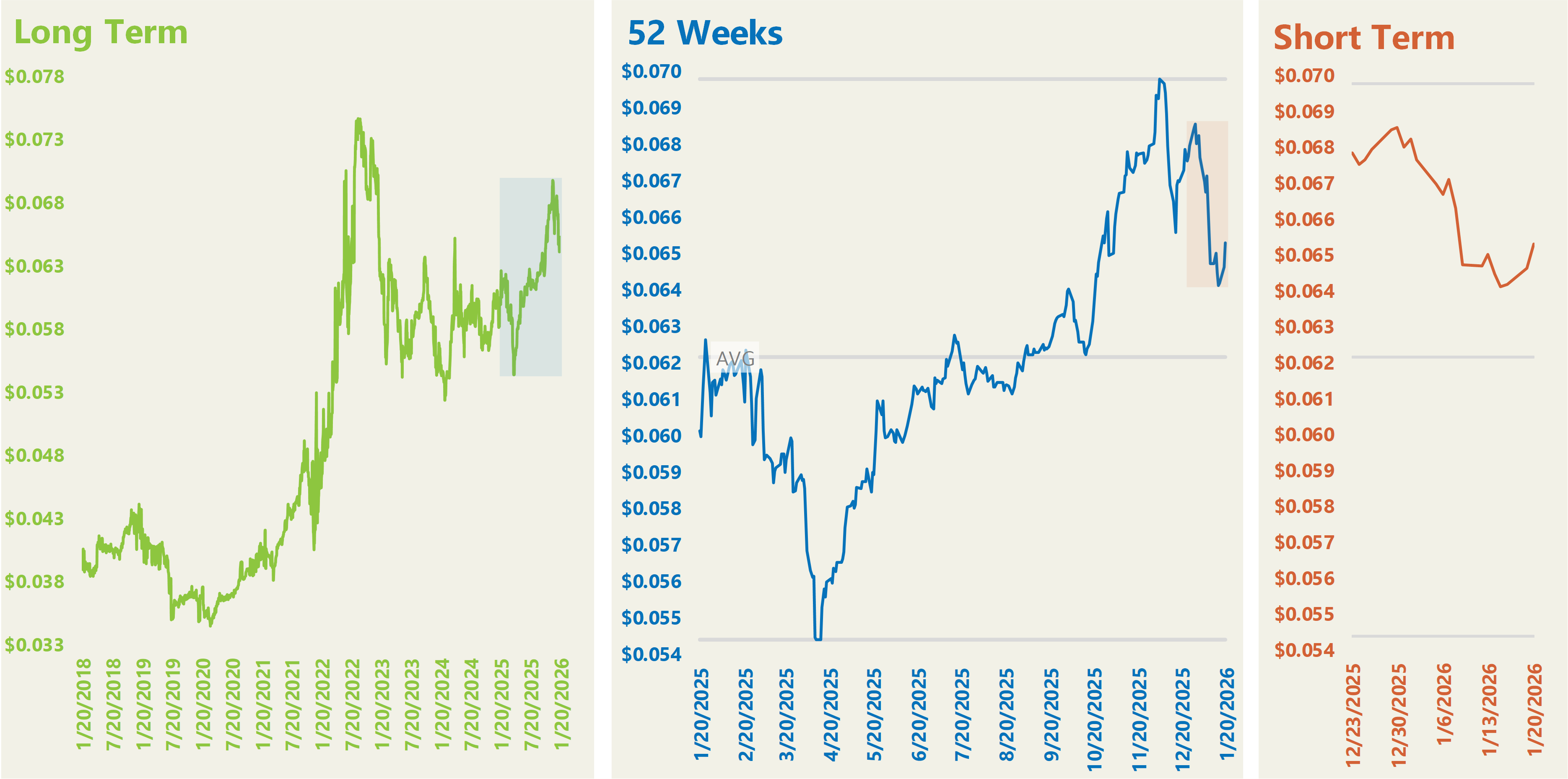

Henry Hub

Henry Hub prices are currently down about 7.2% from the June 19 52‑week high, which is roughly 3.1% below the average.

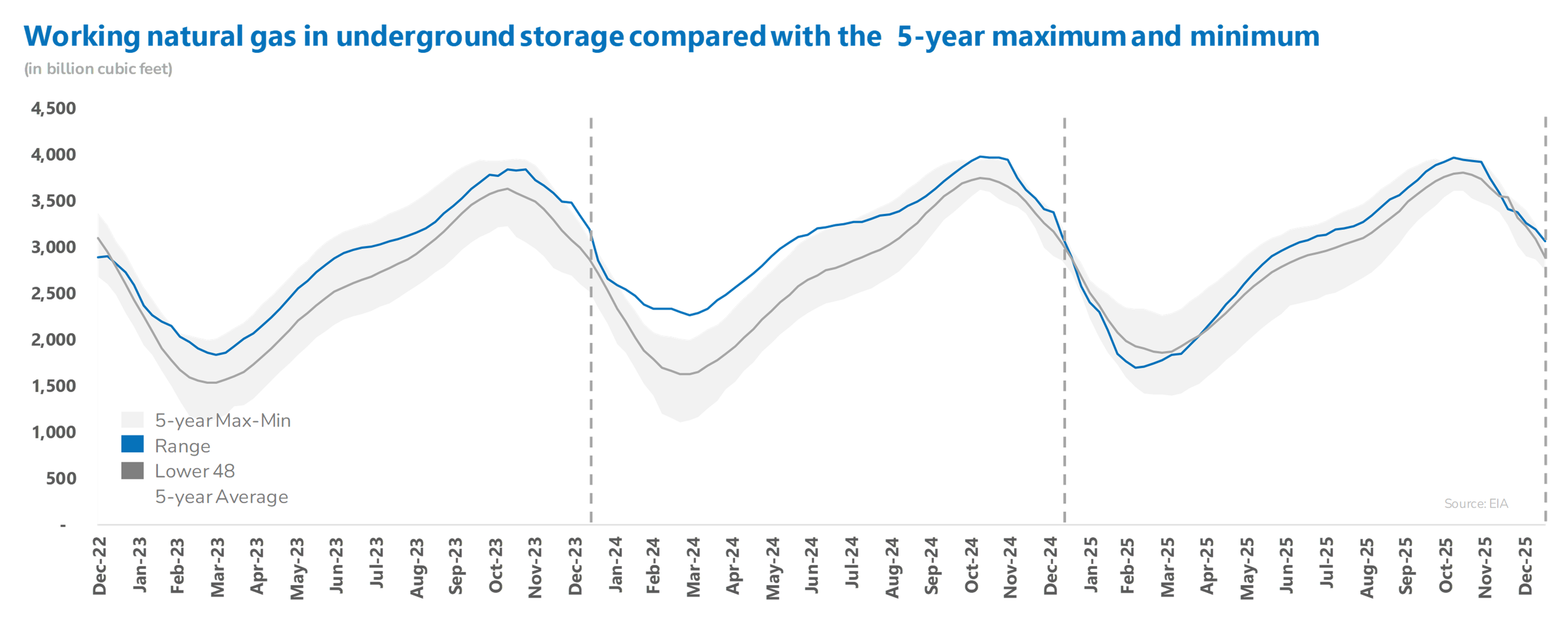

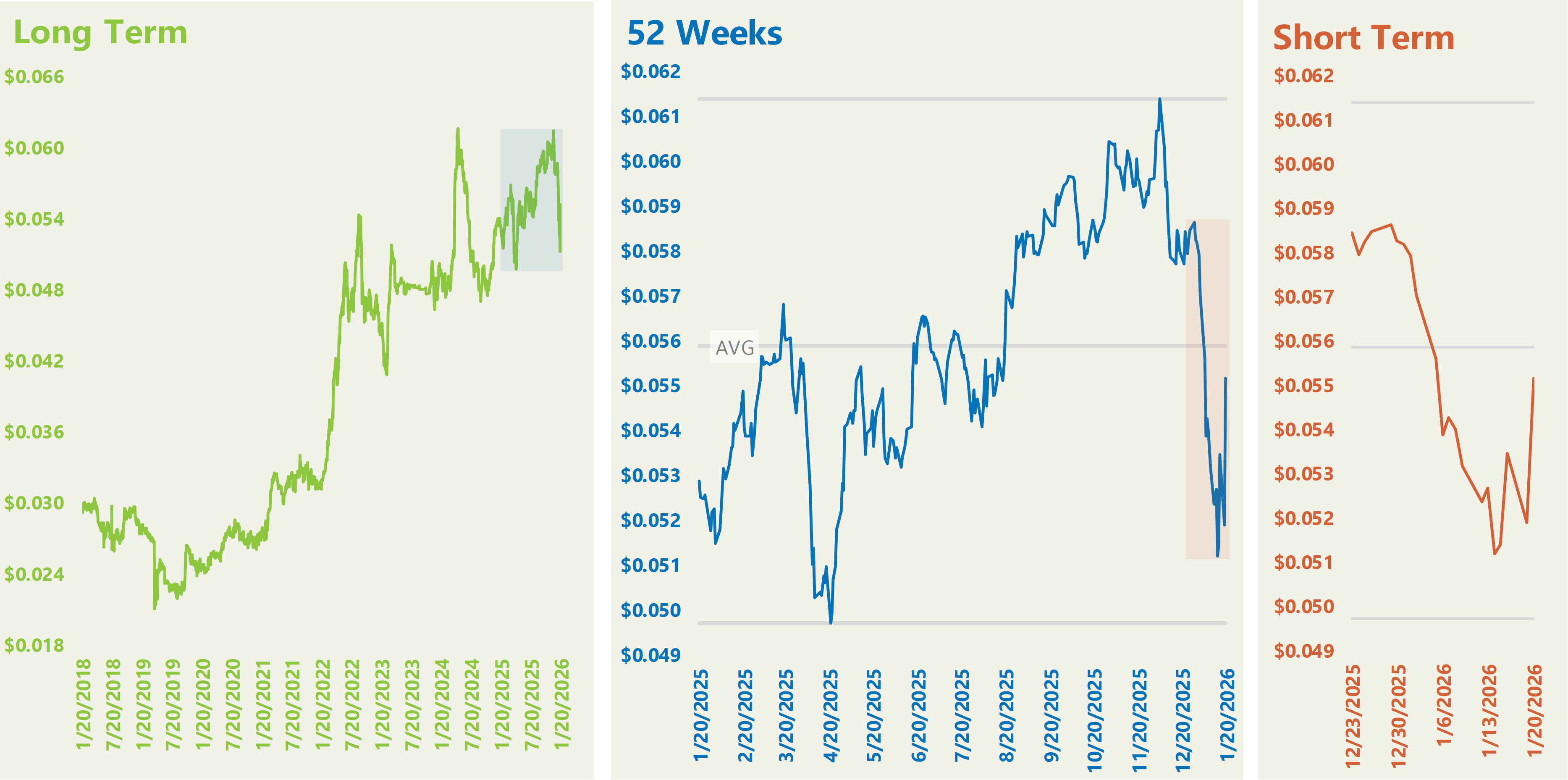

Henry Hub Wholesale Calendar Year 2027 Week-to-Week Fluctuation ($/Therm)

The graphs above show the price movement of the Calendar Year 2027 Henry Hub Wholesale Natural Gas over various periods of time. The price of the calendar year is shown on the left y-axis in relation to the date of the pricing on the bottom x-axis. On the 52-week and short-term graphs, you can see the minimum, maximum, and average price of the past 52 weeks indicated by the gray lines.

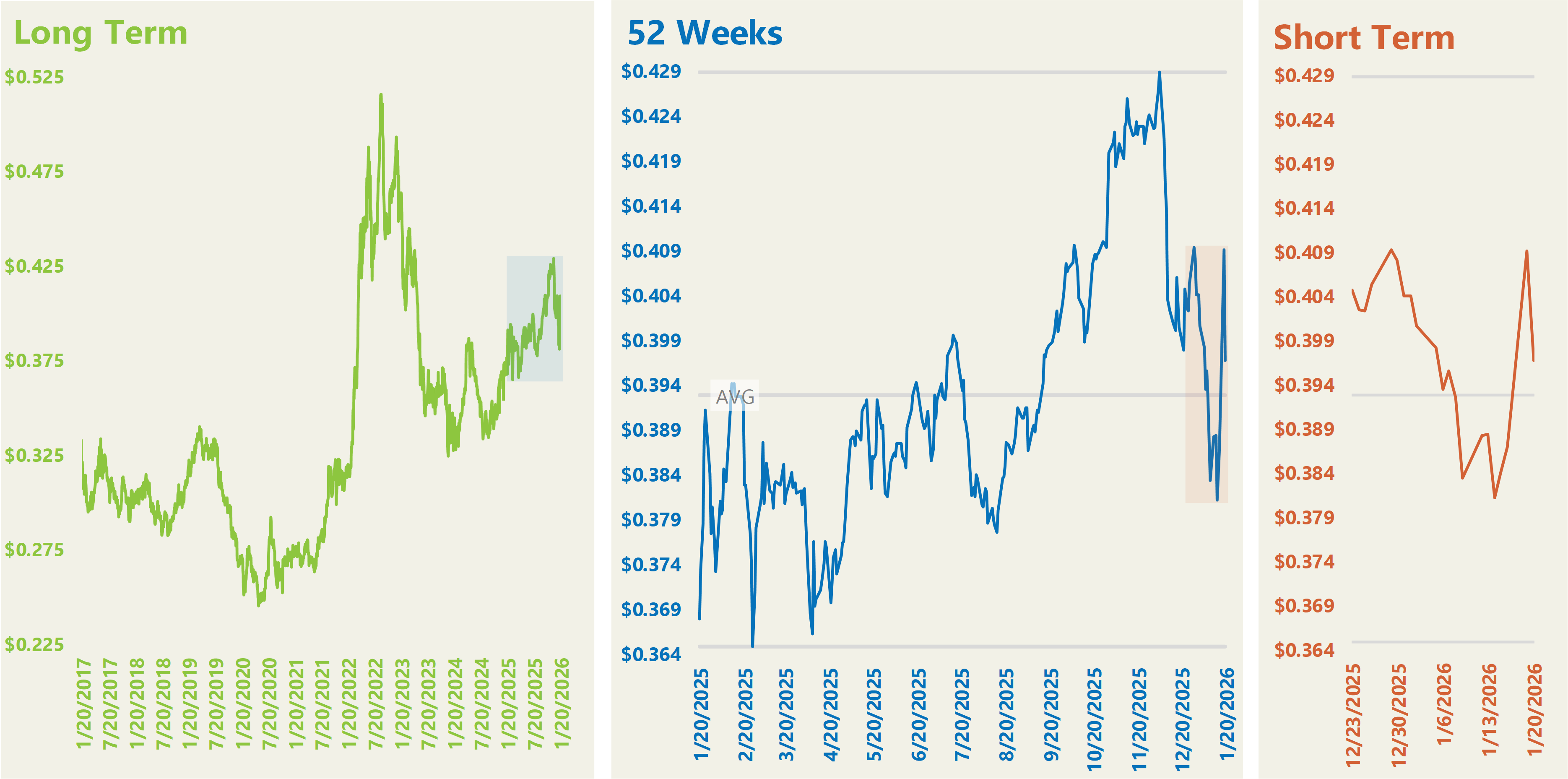

Algonquin City Gate

Algonquin prices are currently down about 4.2% from the December 5 52‑week high, which is about 5.4% above the average.

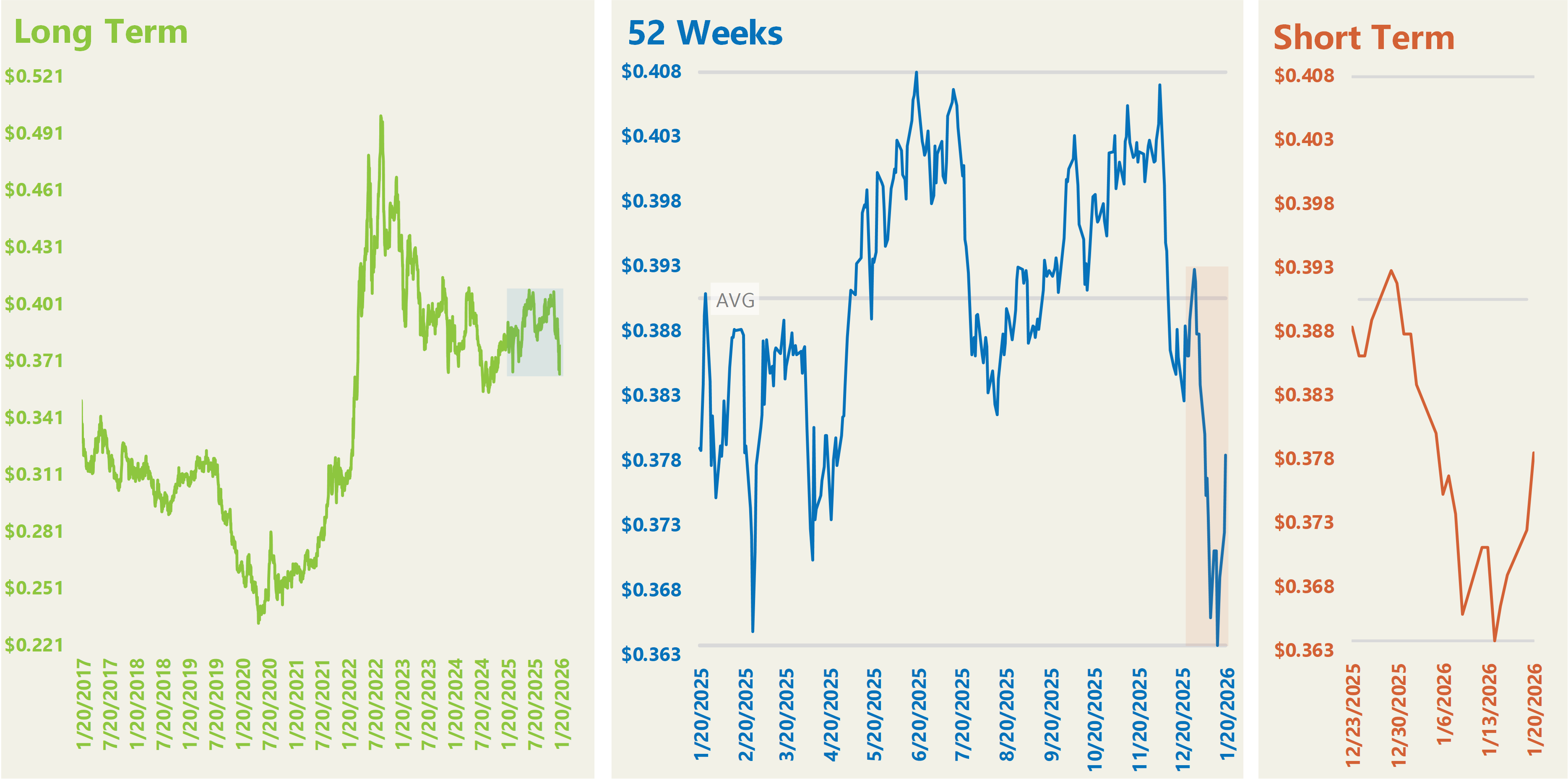

Algonquin Wholesale Calendar Year 2027 Week-to-Week Fluctuation ($/Therm)

The graphs above show the price movement of Calendar Year 2027 Algonquin Wholesale Naural Gas over various periods of time. The price of the calendar year is shown on the left y-axis in relation to the date of the pricing on the bottom x-axis. On the 52-week and short-term graphs, you can see the minimum, maximum, and average prices of the past 52 weeks indicated by the gray lines.

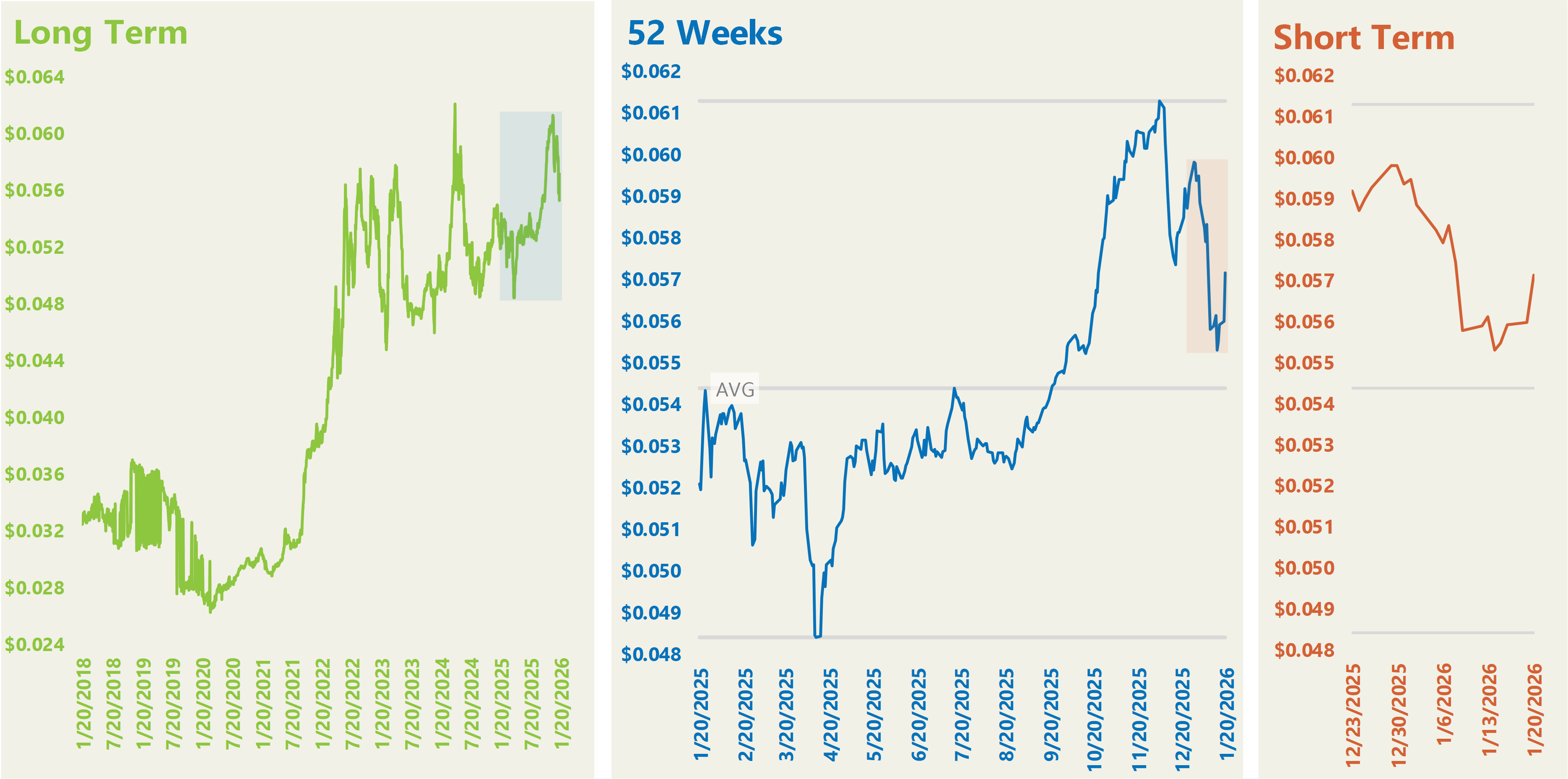

ISO-NE

ISO‑NE prices are currently down about 6.4% from the December 5 52‑week high, which is approximately 5.1% above the average.

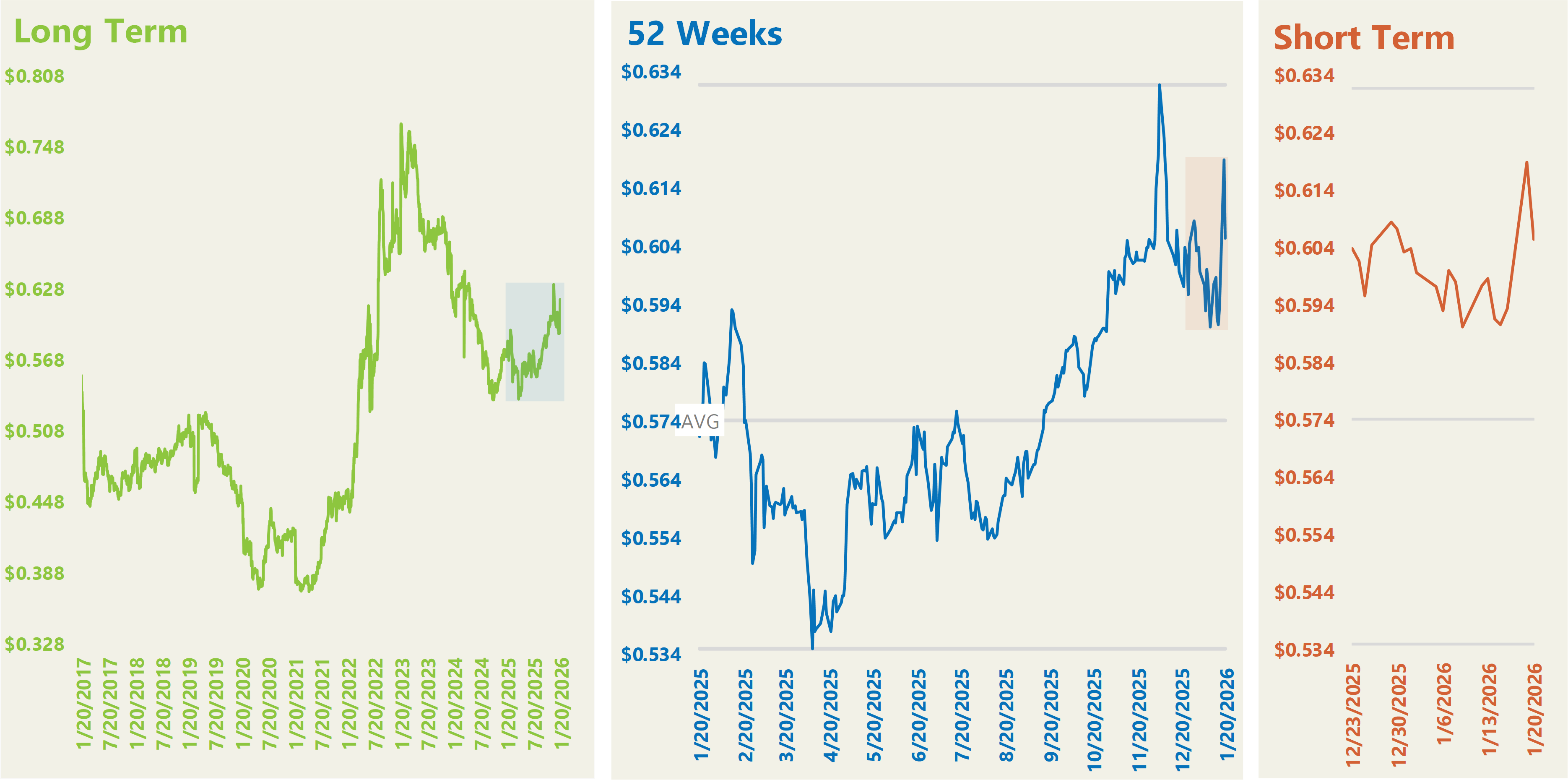

ISO-NE Internal Hub ATC DA Wholesale Calendar Year 2027 Week-to-Week Fluctuation ($/kWh)

The graphs above show the price movement of Calendar Year 2027 ISO-NE Internal Hub ATC DA Wholesale Electricity over various periods of time. The price of the calendar year is shown on the left y-axis in relation to the date of the pricing on the bottom x-axis. On the 52-week and short-term graphs, you can see the minimum, maximum, and average prices of the past 52 weeks indicated by the gray lines.

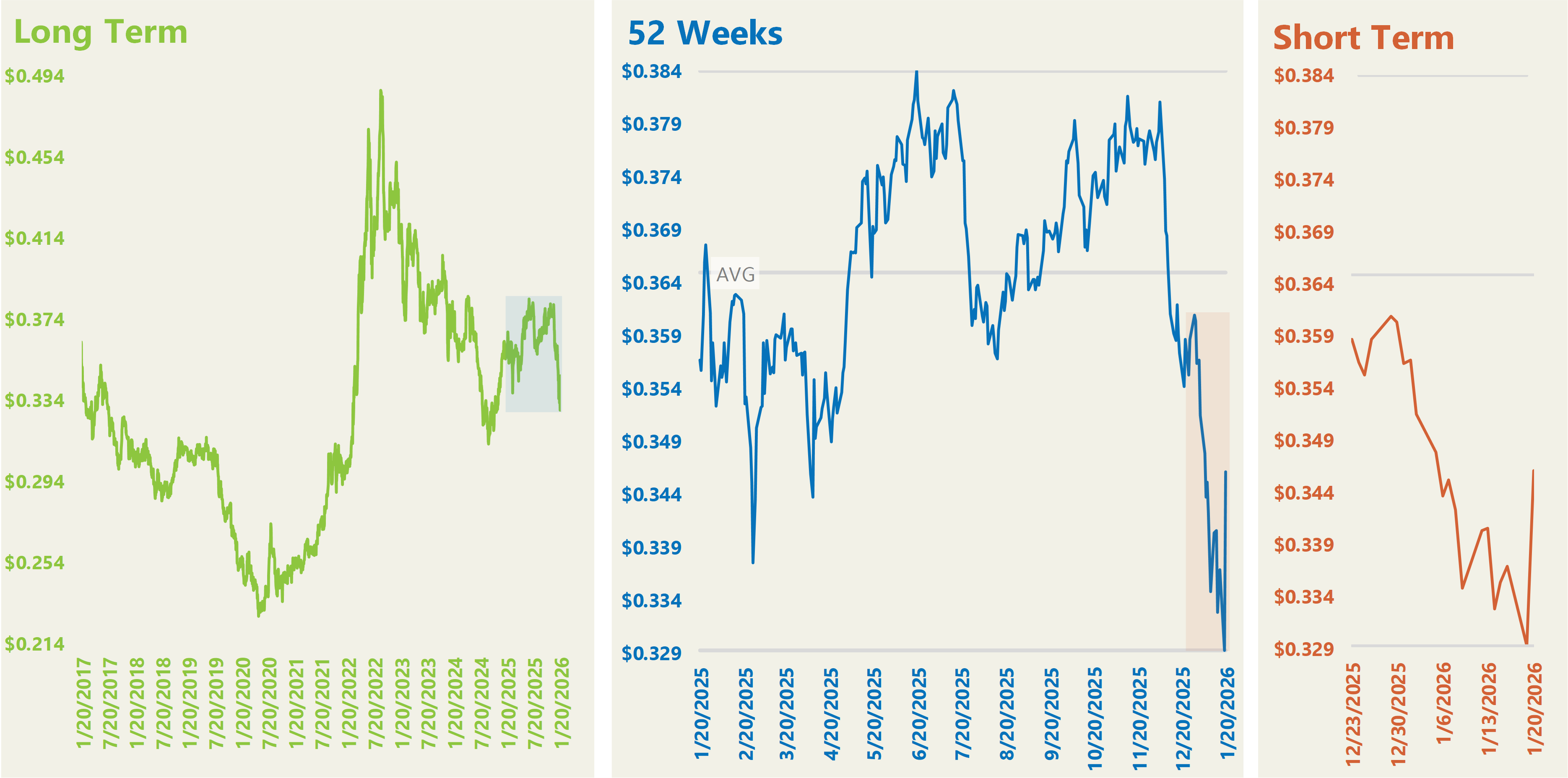

TETCO-M3

TETCO‑M3 prices are currently down about 7.5% from the December 5 52‑week high, which is about 1% above the average.

TETCO-M3 Wholesale Calendar Year 2027 Week-to-Week Fluctuation ($/Therm)

The graphs above show the price movement of Calendar Year 2027 TETCO-M3 Wholesale Naural Gas over various periods of time. The price of the calendar year is shown on the left y-axis in relation to the date of the pricing on the bottom x-axis. On the 52-week and short-term graphs, you can see the minimum, maximum, and average prices of the past 52 weeks indicated by the gray lines.

PJM Western Hub

PJM prices are currently down about 6.8% from the December 5 52‑week high, which is approximately 5.1% above the average.

PJM Western Hub ATC DA Wholesale Calendar Year 2027 Week-to-Week Fluctuation ($/kWh)

The graphs above show the price movement of Calendar Year 2027 PJM Western Hub ATC DA Wholesale Electricity over various periods of time. The price of the calendar year is shown on the left y-axis in relation to the date of the pricing on the bottom x-axis. On the 52-week and short-term graphs, you can see the minimum, maximum, and average prices of the past 52 weeks indicated by the gray lines.

Houston Ship Channel

Houston Ship Channel prices are currently down about 9.9% from the June 19 52‑week high, which is roughly 5.2% below the average.

Houston Ship Channel Wholesale Calendar Year 2027 Week-to-Week Fluctuation ($/Therm)

The graphs above show the price movement of Calendar Year 2027 Houston Ship Channel Wholesale Naural Gas over various periods of time. The price of the calendar year is shown on the left y-axis in relation to the date of the pricing on the bottom x-axis. On the 52-week and short-term graphs, you can see the minimum, maximum, and average prices of the past 52 weeks indicated by the gray lines.

ERCOT Houston

ERCOT Houston prices are currently down about 10.2% from the December 5 52‑week high, which is about 1.3% below the average.

ERCOT Houston Load Zone ATC RT Wholesale Calendar Year 2027 Week-to-Week Fluctuation ($/kWh)

The graphs above show the price movement of Calendar Year 2027 ERCOT Houston Load Zone ATC RT Wholesale Electricity over various periods of time. The price of the calendar year is shown on the left y-axis in relation to the date of the pricing on the bottom x-axis. On the 52-week and short-term graphs, you can see the minimum, maximum, and average prices of the past 52 weeks indicated by the gray lines.

General Disclaimer: This information is provided as a courtesy to our clients and/or potential clients and should not be construed as an offer to sell or as a solicitation of an offer to buy securities based on, or contracts in or for, any energy commodity. Mantis Innovation does not sell electricity and/or natural gas, and as such, the actual terms and conditions of competitive supply are solely provided for by the competitive supplier’s contract with the client. Reliance on this information for decisions is done so at the sole risk of the reader, and past performance is not indicative of future results. This information is provided as a general description of various electricity and/or natural gas purchasing strategies that may be decided upon by our clients. Both clients and potential clients should consider their individual circumstances and other sources of available information before arriving at a decision. Graphs and charts are for illustrative purposes only.